Check MSME Status of your Vendors

Ensure MSME Returns (Form 1) & Section43b (IT) compliance

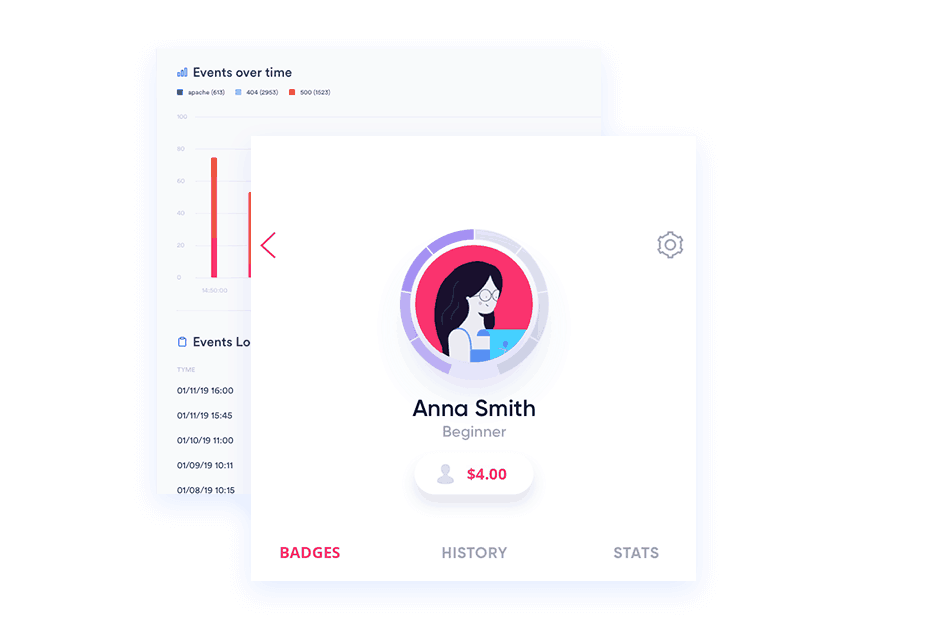

MSME vendor status check from SignalX. Ensure business compliance with MSME form 1 regulation.

Provide PAN, Check if your vendor is an MSME or not

Provide PAN to fetch MSME number associated with a vendor

Check the authenticity of MSME numbers provided by your vendors

Ensure Compliance

Verifying the MSME status of your vendors isn’t just about ticking boxes—it’s about protecting your company’s integrity. By aligning with CARO declarations and MSME Form 1 filings, you demonstrate transparency and strengthen ethical business practices.

Extend Benefits

Build stronger vendor relationships by verifying MSME status. It enables you to offer early payments, better credit terms, and reliable support—positioning your company as a collaborative, responsible, and future-ready business partner committed to sustainable growth.

Avoid Penalties

Stay ahead of financial risks by proactively checking vendor MSME status. Avoid delays, penalties, and compliance issues. Safeguard your cash flow, stay audit-ready, protect credibility, and uphold your brand’s business reputation in a rapidly evolving regulatory landscape.

Why Verify MSME Status of Your Vendors?

Verifying the MSME status of your vendors is crucial for staying compliant with Indian regulations. It helps you avoid penalties, ensure timely payments, and build stronger vendor relationships.

Ensure Regulatory Compliance

Declare MSME dues on time through MSME Form 1 and stay aligned with mandatory reporting norms.

Avoid Penalties and Legal Risk

Non-compliance can lead to interest charges, heavy penalties, and even imprisonment for responsible officers.

Follow Finance Act 2023

The latest Finance Act enforces timely payments to MSMEs, directly impacting your tax deductions.

Meet CARO 2020 Requirements

Auditors are now required to report unpaid MSME dues—making vendor verification a compliance priority.

Improve Financial Accuracy

Delayed payments can distort your financials and require provisions for statutory interest under MSME laws.

Strengthen Vendor Relationships

Recognizing and supporting MSMEs builds trust, ensures entitlement benefits, and fosters long-term collaboration.

Get the below details on any MSME with the SignalX Udyam Verification

A small river named Duden flows by their place and supplies it with the necessary regelialia. It is a paradise

How SignalX can help you?

A small river named Duden flows by their place and supplies it with the necessary regelialia. It is a paradise

What People Say

Share processes an data secure lona need to know basis without the need

Our prices are clear and straight forward

A small river named Duden flows by their place and supplies it with the necessary regelialia. It is a paradisematic country, in which river named Duden flows by their place and supplies it with the necessary

River named Duden flows by their place and supplies it with the necessary A small river named Duden flows by their place and supplies it with the necessary regelialia. It is a paradisematic country, in which

FAQs

MSME Form 1 is a half-yearly return that specified companies need to file regarding their outstanding payments to Micro and Small Enterprises (MSME). Specified companies are types of companies as defined in Section 9 of the Micro, Small and Medium Enterprises Development Act, 2006. The form is required to be filed within 30 days from the date of deployment of E-form MSME-1 on the MCA Portal.

Companies need to identify if their suppliers are registered or not under the MSME Act, 2006. When the suppliers are registered under the MSME Act, and there are outstanding dues by a company to the MSME suppliers, it must file Form MSME-1. Specified companies should file Form MSME-1 when payments are due to MSME for more than 45 days from the date of acceptance of the services or goods, along with the reason for its delay.

You can check the MSME Status of your vendor with SignalX by giving the PAN details associated with the vendors. Once the check is done, you get details like, whether your vendor is a registered MSME, which category of MSME your vendor falls under, the UAM number associated with the MSME registered vendors, and many more other details.

To file MSME Form 1, companies need to adhere to the following due dates:

- From April to September: The form must be filed by 31st October.

- From October to March: The form must be filed by 30th April

It is important for companies to file the form within the specified timelines to ensure compliance with the regulations. Non-compliance with filing MSME Form 1 can lead to penalties under Section 405(4) of the Companies Act, 2013.

In case of delayed payments to Micro and Small Enterprises (MSME) vendors, there are penalties and consequences that companies may face. Such penalties includes:

In case of delayed payments, companies are liable to pay interest on delayed payments to MSME registered suppliers. The rate of interest is three times the bank rate notified by the Reserve Bank of India

If a company files MSME Form 1 after the due date or fails to file it, the company is liable for a penalty under Section 450 of the Companies Act, 2013.

The company and every officer in default will be liable to a penalty of Rs. 25,000. In case of continuing failure, an additional penalty of Rs. 500 per day will be imposed

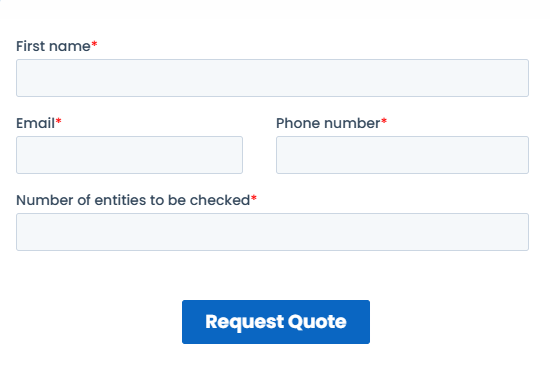

Check MSME Status of your Vendors

Request a Quote to get started!